Tariffs have made headlines, influencing markets and creating uncertainty for investors. Specifically, the tariffs introduced during President Trump’s administration significantly impacted the U.S. economy and its trading relationships. At Falcon Wealth Planning, we believe understanding these impacts helps you make informed financial decisions, even in uncertain times.

What Exactly Are Tariffs

Tariffs are essentially taxes that governments place on imported goods. These duties aim to:

- Protect local industries by making foreign products more expensive.

- Encourage domestic production.

- Generate revenue for the government.

- Reduce reliance on imports.

- Respond strategically to other nations’ trade practices.

However, tariffs can also increase costs for consumers and disrupt international trade relations, affecting overall economic growth.

A Look Back at Trump’s Tariff Policy

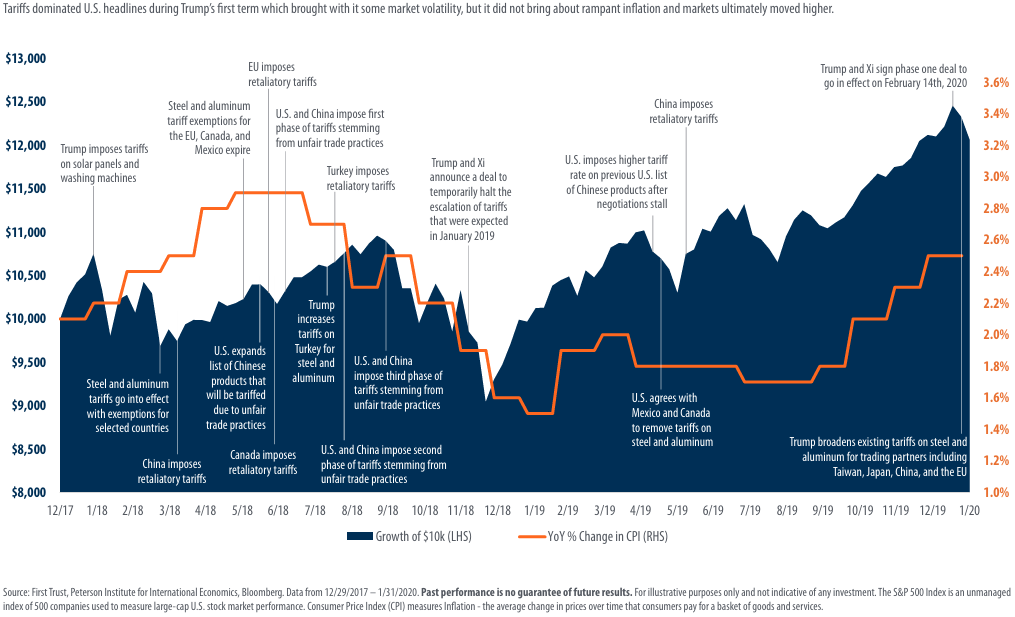

From 2017 to 2020, tariff policy underwent significant shifts:

- 2018: The Trump administration introduced tariffs on solar panels and washing machines, followed by steel and aluminum tariffs affecting key trade partners like China, Canada, and the EU.

- Throughout 2018 and 2019, a series of retaliatory tariffs between the U.S., China, and other nations escalated tensions and market volatility.

- Despite fears, these tariffs did not trigger severe inflation, and markets ultimately trended upward, as evidenced by the performance of the S&P 500 Index.

Historical Context: U.S. Tariff Rates

Tariffs aren’t new—they’ve played a central role throughout U.S. history:

- Initially, tariffs were the U.S. government’s primary revenue source until the federal income tax emerged in 1913.

- The average effective U.S. tariff rate has significantly declined over the past 40 years, driven by free trade policies and global supply chains.

Tariff Revenue and Economic Adjustments

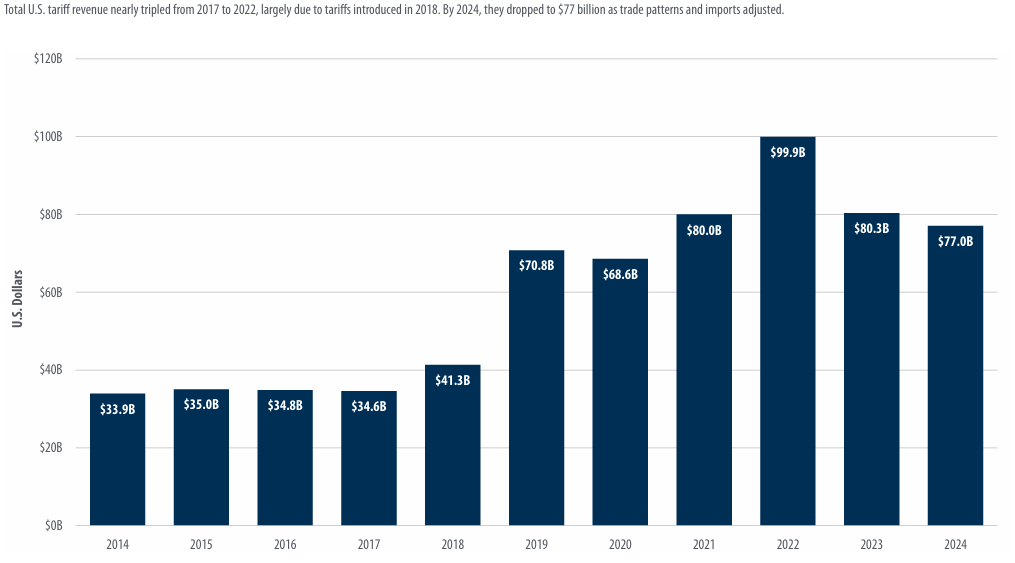

The Trump-era tariffs led to a notable rise in tariff revenue:

- U.S. tariff revenue nearly tripled from 2017 to 2022.

- However, by 2024, revenue declined as trade patterns adjusted to the new economic landscape, highlighting how global markets often recalibrate in response to policy changes.

U.S. Trade Patterns Today

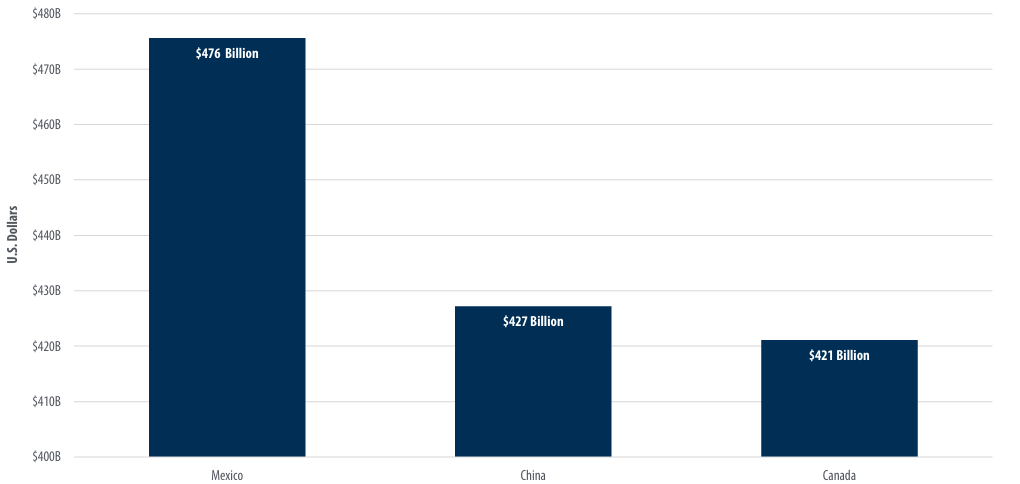

The tariffs initiated a reshuffle in trade dynamics:

- Mexico has overtaken China as the top exporter to the U.S., closely followed by Canada.

- Different states have varying trade relationships. For example, Canada is the top exporter to 22 U.S. states, while Mexico and China each lead in 10 states.

- Canada and Mexico dominate trade in major categories like automobiles and crude oil, while China remains vital for technology imports like computers and phones.

Why Tariffs Matter to Investors

While tariffs and trade policies often generate headlines, their practical implications are profound:

- Consumer Prices: Tariffs generally result in higher costs for imported goods, affecting both businesses and consumers directly.

- Market Volatility: Uncertainty surrounding trade policies can cause short-term market fluctuations, presenting challenges and opportunities for investors.

- Economic Adjustments: Long-term, markets adapt and often stabilize, underscoring the importance of a well-diversified portfolio and a thoughtful investment strategy.

Preparing Your Portfolio for Volatility

At Falcon Wealth Planning, our priority is helping you navigate volatility with a disciplined approach:

- Diversification: Spreading investments across various asset classes and sectors.

- Regular Reviews: Continuous evaluation and adjustments to align with changing market conditions.

- Tax Planning: Strategic planning to optimize tax efficiencies, especially during times of economic shifts.

The era of Trump tariffs teaches us that volatility is an inherent part of the market landscape. While policies and market conditions may shift, your long-term financial goals shouldn’t.

How Falcon Wealth Planning Can Help

Market fluctuations can feel overwhelming, but with professional guidance, they don’t have to derail your financial plan. At Falcon Wealth Planning, we provide clarity and confidence, guiding you through the complexities of the market.

Reach out to us today to discuss how we can help you navigate market volatility effectively.

*The content in this blog is for general informational purposes only and does not constitute personalized financial, investment, tax, or legal advice. Falcon Wealth Planning, Inc., a fee-only, true fiduciary, registered investment advisor, provides this information to give a broad understanding of financial concepts and strategies.